Articles

Trust and Estate Litigation: What’s Almost as Certain as Death? Not Talking About Your Children’s Inheritance

The New York Times cover story in the business section last weekend discussed the importance of discussing your children’s inheritance with your children and the potential of trust and estate litigation. It read: What’s Almost as Certain as Death? Not Talking About the Inheritance The article states that while 84% of people surveyed had… Read More »

The New Definition of Undue Influence – Irvine, Orange County

The definition of undue influence as we knew it changed on October 9, 2013, when Governor Jerry Brown signed AB 140, changing the definition of undue influence in Orange County, and all of California as “excessive persuasion that causes another person to act or refrain from acting by overcoming that person’s free will and… Read More »

Super Lawyers Magazine selects Anh Tran as a 2014 Rising Star in Estate Planning and Probate

Super Lawyers is a rating service of outstanding lawyers in estate planning and probate, who have attained a high-degree of peer recognition and professional achievement. The selection process is multi-phased and includes independent research, peer nominations and peer evaluations. Super Lawyers Magazine features the list and profiles of selected attorneys for each area of… Read More »

How Should You Take Title to Your Home? (Part 3 of 3)

Something that is often overlooked when buying your home is how you should take title to your home. For most of you, when you buy a home, your biggest concerns are with the price, the location, the aesthetics, the school district, etc. Once you find the home of your dreams, you’ve qualified for the… Read More »

How to Avoid Paying Capital Gains Taxes When You Sell Your Home (Part 2 of 3)

Once you calculate your capital gains when you sell your home, the next step is figure out how to avoid paying capital gains taxes when you sell your home. Capital Gains Tax Exclusion on the Sale of Your Home You probably know that, if you sell your home, you may exclude up to $250,000… Read More »

How Do You Calculate Capital Gains Taxes When You Sell Your Home? (Part 1 of 3)

Before you can calculate the capital gains taxes on the sale of your home, you must first understand basis. The examples below are for illustrative purposes only. For a complete understanding and a full review of your specific situation, contact an Orange County Estate Planning Attorney at Modern Wealth Law. What is the Basis… Read More »

Setting Up an Out of State Corporation by a California Resident

California residents often ask me, “should I set up an out of state corporation to save or avoid taxes?” California residents often mention Nevada because it has no corporate income tax and no personal income tax. Many “business advisors” promote these Nevada LLCs or corporations for this very reason (with the caveat that they… Read More »

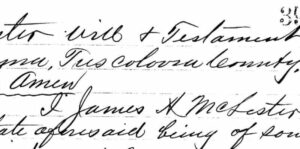

Should You Write Your Own Will or Trust?

Often times I’m asked, “can you write your own Will or Trust?” The simple answer is yes, you can write your own Will or Trust. However, you can also perform your own surgery, invest your own assets and buy your own house. But as a doctor, financial advisor and real estate agent will tell… Read More »

Undue Influence – I’ll Love You More If You Buy Me a Chanel Bag

Undue influence is often times a key factor in Trust and Probate Litigation proceedings. Here is the classic undue influence case: Old man, Carl, and old woman, Lucy have 2 kids. Unfortunately, Lucy dies at 75. After some mourning, Carl gets back on his feet. Carl decides that he still has a lot of… Read More »

Trustee Liability for Injuries on Trust Real Property

Recent Trustee Liability Case – This recent case reviews trustee liability over trust real property. Where real property was owned by a trust, trustee could not be held personally liable for injuries suffered on the premises unless trustee was “personally at fault” within the meaning of Probate Code Secs. 18001 and 18002–meaning that trustee… Read More »